Explainer: GST 2.0: India Announces Tax Reforms With Focus On ‘Common Man’

GST 2.0 by the Indian Govt on 3rd September came as a smart counterpunch to lessen the burden of the common man and boost the Indian economy. The 56th meeting of the Goods and Services Tax (GST) Council, held on Wednesday, was a 10-hour-long marathon meeting, which was chaired by Union Finance Minister Niramala Sitharaman and attended by ministers from across 31states and Union Territories. Indian govt. on Wednesday announced tax cuts on hundreds of consumable items ranging from soaps to small cars under GST 2.0 and loosened the burden on its own people.

The newly approved GST 2.0 paves the way for two structures of 5 and 18 per cent and replacing the slab structure of 12% and 28%. The new two-tier slab structure will be effective from 22nd September, replacing the current four slabs of 5%, 12%, 18%, and 28%. However, for sin goods and luxury cars costing above 50 lakhs, a 40% slab has been introduced.

GST 2.0 Major Reforms

During his Independence Day speech at the Red Fort, Prime Minister Narendra Modi called for greater self-reliance in India, which was highly triggered after Donald Trump’s decision of 50 per cent Tariffs on India. Narendra Modi in his speech to the nation pledged to lower the GST by October, which will now be implemented from September 22. Exceeding expectations, the Goods and Services Tax (GST) Council shifted most items from 12 per cent or 18 per cent bracket to 5 per cent. The council further abolished 12 and 28 per cent slabs, making consumption of consumable items affordable and easier for common people.

Though the common man is at the beneficiary end after the new slab structures, it’s also the broader vision of the government that has been kept in mind while implementing GST 2.0. The new reforms in the Goods and Services Tax will also facilitate the ease of doing business with automated refunds and the registration process.

Sector-Wise GST Reforms

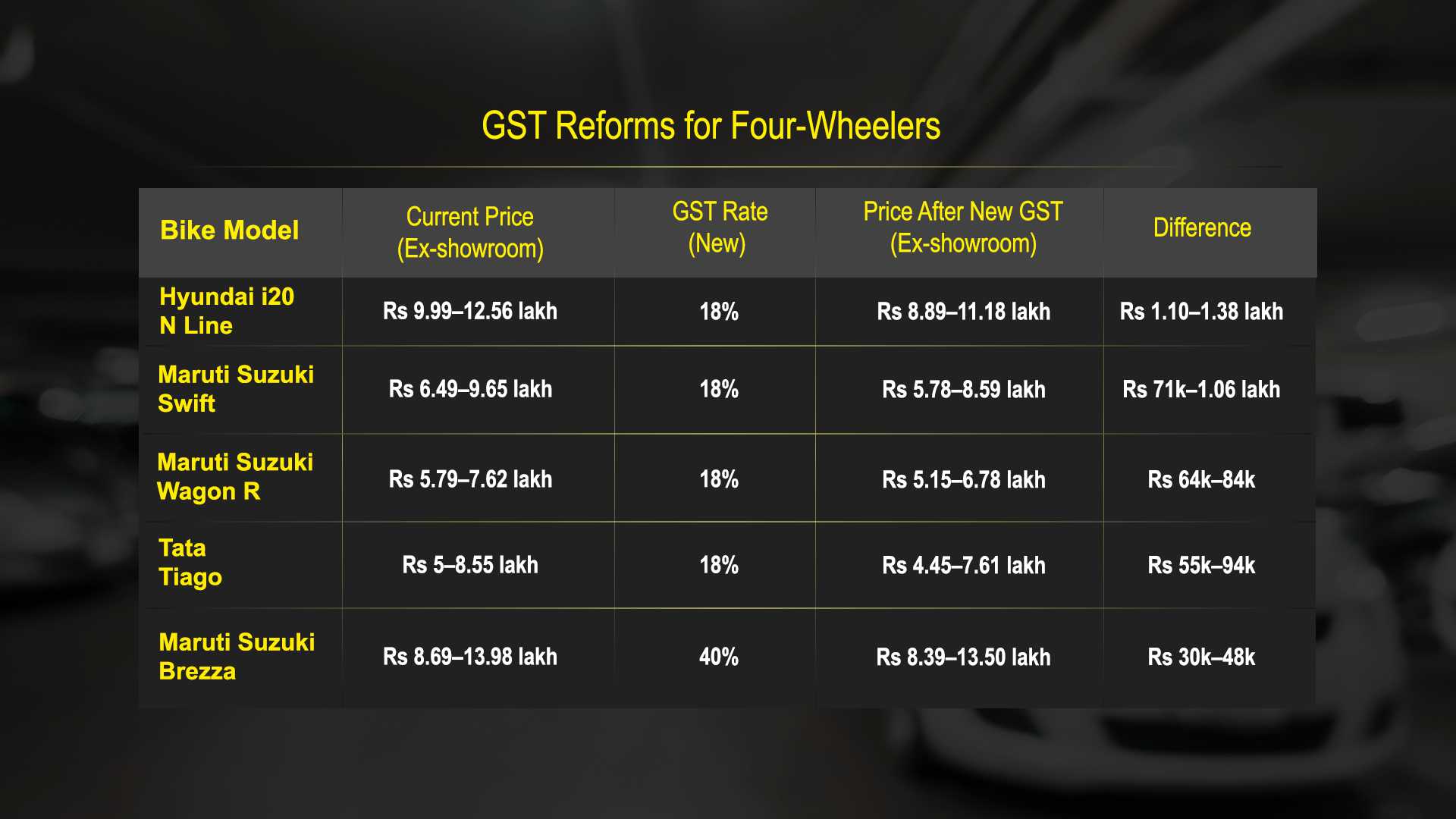

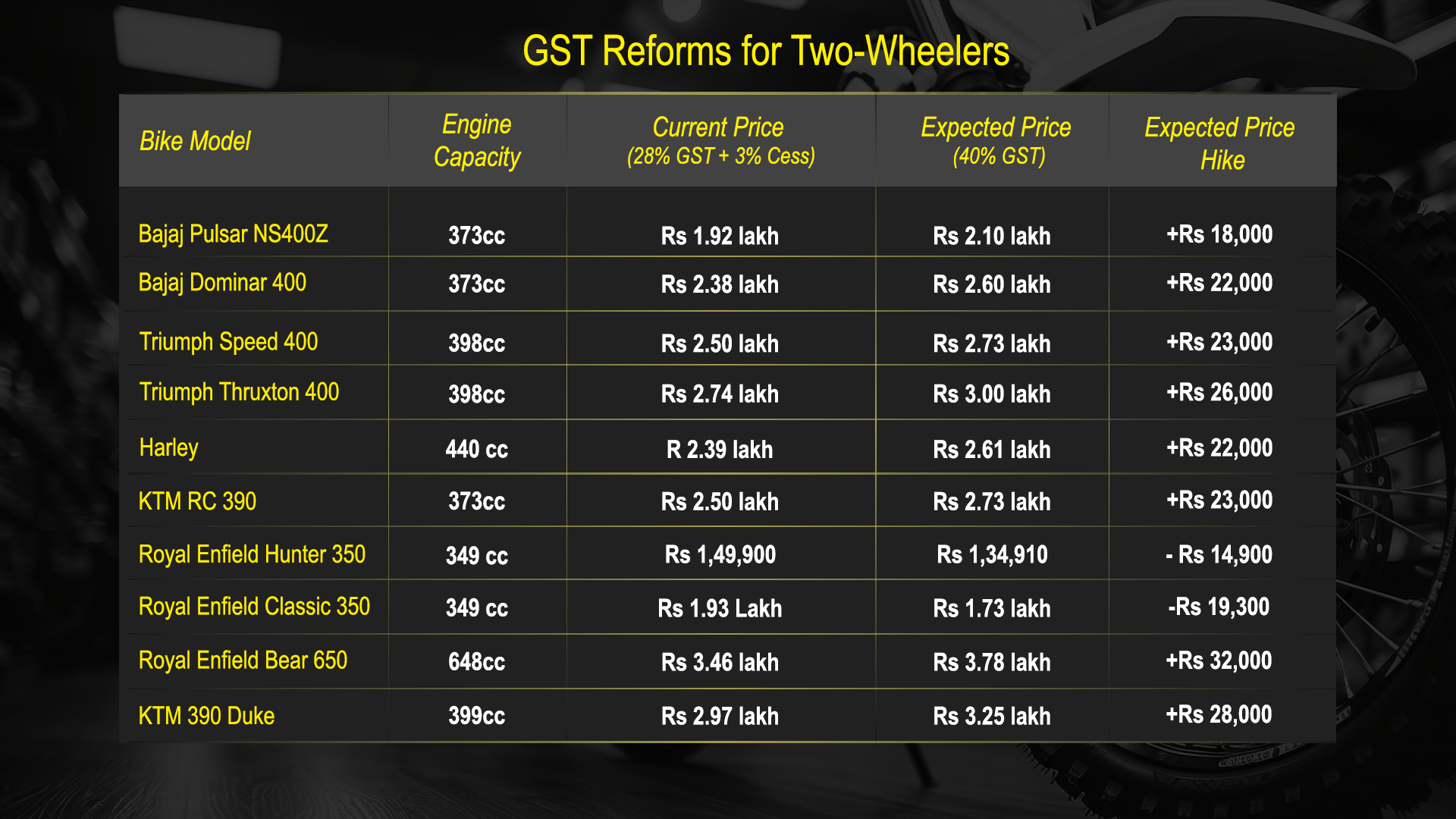

GST Reforms in the Automobile Sector

Indian Automobile Sector has been bifurcated under three slabs of 5%, 18%, and 40%. The GST reforms will have a positive impact on the automobile industry, further it will be implemented from 22nd September, just before the Indian festive season, which would also help domestic sales to pick up. However, electric vehicles will remain at 5% slab.

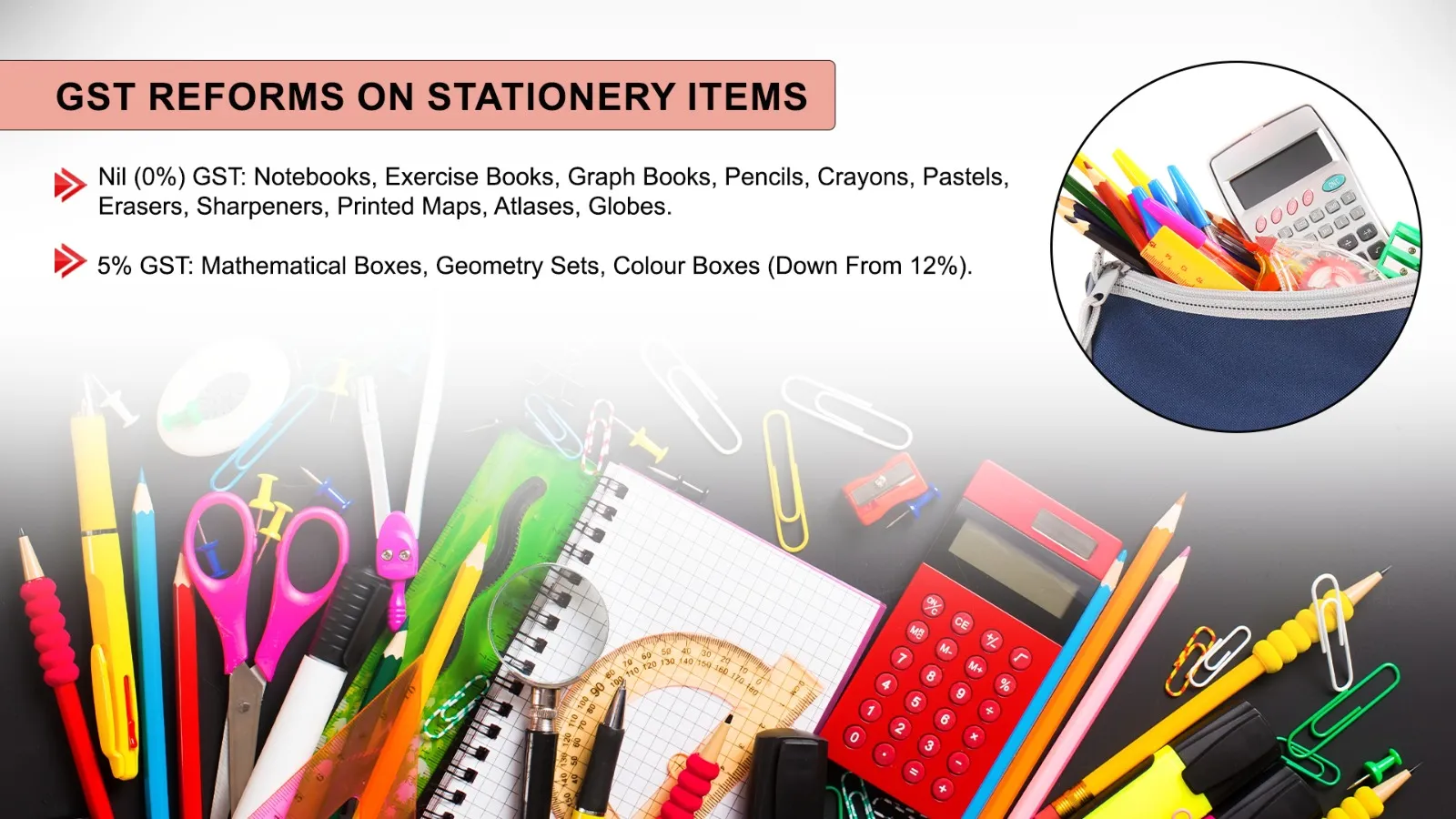

GST Reforms on Stationery Items

The new GST reforms in stationery & related goods is part of a broader GST reform that simplifies the current 4-tier structure into two slabs, 5 and 18%. Here’s a breakdown of the new GST reforms on Stationery Items.

GST Reforms on Health Sector

Depicting a keen focus on the common man, the central government exempted GST on all individual life insurance policies, whether term life, ULIP or endowment policies, all individual health insurance policies, including family floater policies and policies for senior citizens and reinsurance thereof.

The govt. further announced the reduction of GST from 12 per cent to NIL on 33 life-saving drugs and medicines, and from 5 per cent to NIL on three life-saving drugs used for the treatment of cancer, rare diseases, and other severe chronic conditions. GST on medical apparatus and devices used for medical, surgical, dental, or veterinary purposes has also been reduced from 18 per cent to 5 per cent.

GST Reforms on Luxury and sin goods

40% tax slab has been designed for luxury and non-essential goods such as high-end vehicles, aerated drinks and tobacco products. Luxury Goods that will attract 40% GST include Petrol cars with engine capacity above 1200 cc, Diesel cars with engine capacity above 1500 cc and Motorcycles with engine capacity above 350 cc. Moreover, Sin goods such as Pan Masala, Gutka, Chewing tobacco, Unmanufactured tobacco and tobacco refuse (excluding leaves), Cigarettes, Cigars, cheroots, cigarillos, and similar substitutes have all attracted the highest slab which has been about 40%.

GST Reforms on Agriculture Sector

The new GST Reforms have introduced a big boost for farmers as the GST council has reduced the goods and services tax rates on several farm goods to 5 per cent from 12 per cent, including tractors, agricultural, horticultural or forestry machinery for soil preparation or cultivation, lawn or sports-ground rollers, nozzles for drip irrigation equipment or nozzles for sprinklers. In addition, specified bio pesticides, natural menthol, etc, will be available at 5% from the previous 12% effective from 22nd September.

GST Reforms on Food items (Packaged foods), Nuts, and dry fruits

Next-generation GST reform is a good time for you to be a foodie.

Food essentials such as milk, specifically ultra-high temperature milk, will now be tax-free (down from five per cent), while condensed milk, butter, ghee, paneer, and cheese have moved from 12 per cent to five per cent or nil in some cases. Parathas and parottas, which earlier drew 18 per cent tax, move to the nil bracket under GST 2.0.

Apart from these essentials, other food staples, including malt, starches, pasta, cornflakes, biscuits, and even chocolates and cocoa products, will now attract a five per cent GST from the previous 12-18 per cent. Furthermore, Dry fruits like almonds, pistachios, hazelnuts, cashews, and dates, which were earlier in the 12 per cent slab, have been moved to the five per cent slab.

GST 2.0: A Boon or A Bane?

Interestingly, lower and improved tax reforms will increase consumption and goods within the reach of the common man. Further, the govt. has also reformed GST rates on cement to 18% and fly ash bricks to 5% will reduce the construction costs. While few have raised a concern about a possible loss of Rs 50,000 crore after the new two-tier slab structure, but experts and Revenue Secretary Arvind Shrivastava said that “it is not correct to term it as a revenue loss”.